Business segments

We invest in Ground Lease Properties (land) via affiliated companies - as part of sale-and-lease-backs with property holders or co-investments with investors via new acquisitions.

Transaction security

We rely on solid partnerships, well-established structures and short decision-making processes.

Holistic approach

In the context of our investments, it is a matter of course for us that we offer holistic solutions. By this we mean the identity of interests between the building owner, the financing bank and the Ground Lease owner.

Win Win

We always ensure that all partners realise advantages in the context of our investments compared to an investment in full ownership - this applies in particular to building investors

Our advantages

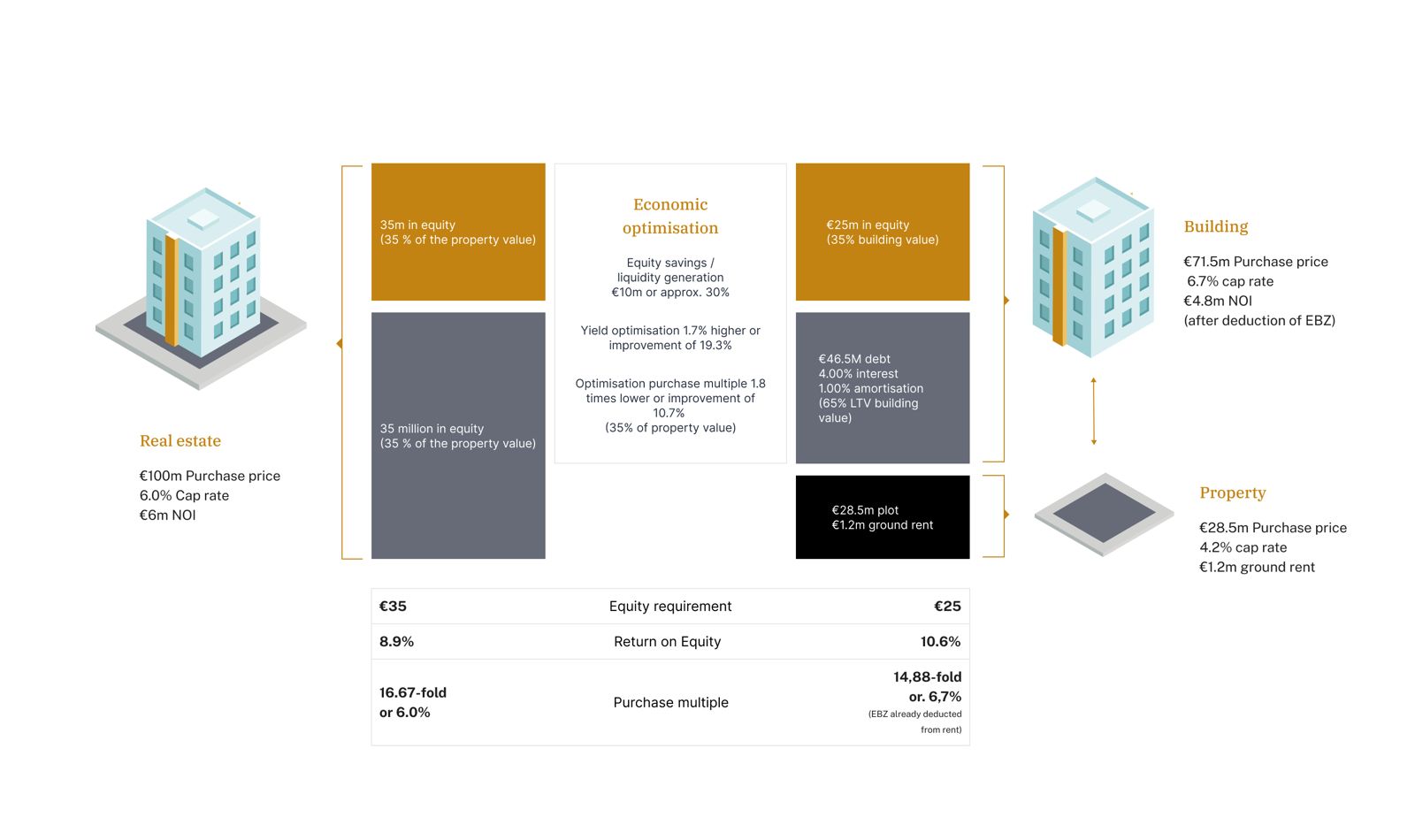

The economic advantages are achieved by utilising the leverage effect, as the sum of the land price and debt financing for buildings is greater than the debt financing for buildings with land.

This means that significantly less equity has to be utilised and significant liquidity is freed up. In addition, the relevant key financial figures such as RoE and CoC are increased

Sale-and-Lease-Back

- Significant generation of liquidity

- No refinancing risk, as there is no redemption and repayment obligation (comparable to perpetual bonds)

- Independence from banks

- Long-term utilisation of the property for up to 198 years plus extension option

- Increase in return on equity and cash-on-cash

- Positive tax effects: 100% depreciation basis on the building, ground rent tax deductible

- No change in the gearing ratio (classic sale-and-leaseback structure) in accordance with IFRS

- No loss of use: the building investor has rights equivalent to real property, can lend, bequeath, sell and freely manage the building

- No loss of usable space and/or AuM

- Avoidance of distressed sales below market value

Co-Investment

- Significant equity savings

- No refinancing risk, as there is no redemption and repayment obligation (comparable to perpetual bonds)

- Independence from banks

- Long-term utilisation of the property for up to 198 years plus extension option

- Increase in return on equity and cash-on-cash

- Positive tax effects: 100% depreciation basis on the building, ground rent tax deductible

- No loss of use: the building investor has rights equivalent to real property, can lend, bequeath, sell and freely manage the building

- More usable space and/or AuM with the same equity

- Reduction of (absolute) ancillary purchase costs

Sale and Lease-Back / Refinancing

Investors know the situation: capital is tied up in land and buildings, which is needed for refinancing in the current financing environment. Sale and Lease-Back is a form of financing that also offers opportunities in the property sector to release the capital tied up in the property by granting heritable building rights.

The Ground Lease Property (land) is purchased by companies affiliated with us and then leased back from the building owner. The building owner thus quickly obtains liquid funds and can still continue to use the buildings as usual.

Exemplary applications:

- Debt rescheduling, e.g. of outstanding corporate bonds

- Loan repayment / refinancing

- Financing of ESG refurbishments

Co-Investment

We co-operate with a building investor as part of joint acquisitions. A framework deed is used to secure the joint handling of the building and land.

The contractual basis is of particular importance, as a clear division of competences between the partners is crucial for success. This division of competences is clearly regulated within the framework of our business model, as heritable building rights create two independent legal assets, as a result of which the building owner can make autonomous decisions (link ‘virtual full ownership’).

Exemplary applications:

- Acquisition

- Repositioning

- Allocation

Existing Ground Lease Properties

We structure leasehold properties. Mostly via new acquisitions in sale-and-lease-back transactions or co-investments. Of course, we are also interested in existing Ground Lease Properties (land), whereby the quality of the contract is of great importance.